How do New Donation Platforms Work in the Tax System?

There are many ways to platforms that can be used to raise money these days. The following are used commonly for charitable donations.

- GoFundMe

- MyCause

- Raisely

- Fundly

- IndieGogo

- Start Some Good LLC

- Crowdrise

- Causes

With the rise of these new platforms, stringent tax laws have been introduced to ensure Australians are being taxed fairly on their contribution to charities and causes. So, let’s have a look at how charities, individuals, and businesses navigate tax laws to ensure they’re doing the right thing.

Charities

Do Charities Pay Tax?

While there is usually a common assumption that charities don’t pay tax, the truth is that it really depends. Rather than getting a complete free pass, some charities can claim a number of tax concessions from the Australian Government. An income tax exemption is a concession that is awarded to charities that are endorsed by the ATO. With this concession, charities are exempt from paying income tax and may receive a refund on franking credits.

To be eligible for the income tax exemption, charities must meet at least one of three of the following:

- In Australia test – the charity operates physically within Australia and incurs expenditure primarily within Australia.

- Deductible gift recipient (DGR) test – it has been registered by the ATO as an DGR by meeting certain requirements. Brace yourself, there’s a fair few!

- Prescribed by law test – it is exempt from tax in its country of residence or incurs its expenditure primarily outside of Australia while also exempt.

Charities must also meet both of these conditions to claim an income tax exemption:

- Governing rules condition – it follows the governing rules established by the charity that authorise policy, action, and affairs.

- Income and assets condition – it applies its income and assets solely for the purpose for which the charity was established.

On top of the income tax exemption, charities can also be endorsed to receive Goods and Services Tax (GST) and Fringe Benefit Tax (FBT) concessions. These concessions are also contingent on the charity meeting certain requirements such as…

- Having a registered ABN

- Being registered with the Australian Charities and Not-for-profits Commission (ACNC)

- Being registered as a public benevolent institution or health promotion charity may make your charity eligible for an FBT exemption

- Being endorsed to access income tax exemption may make your charity eligible for an FTB rebate

As you can see, working out the specifics with ATO tax concessions is no walk in the park. Not only is there a long list of criteria for charities to meet, but failure to meet certain criteria also causes implications for individuals who donate (if they wish to claim their donation as tax deductible), and those that (with good intentions) raise funds. That being said, we give from the heart – the incentive for many isn’t to get a tax write-off.

How do Charities Distribute Funds?

Much like a business, it takes money to run a charity – the bigger the charity, the more complex its structures become, and the more it costs to operate. While small, charities might be able to run off just volunteers; however, growing a charity means investing in paid staff, marketing, public relations, and other overhead costs. These costs, however, go towards reaching farther communities and spreading awareness. In turn, charities have the capability to raise more money and do more for their cause – but not before covering their administrative costs.

Currently, in Australia, there is no mandatory common accounting standard or set of definitions for charities to use when reporting expenses. This makes it difficult to compare administrative costs amongst Australian charities. In all cases, however, the ANCA states that charities should, “use funds in a way that maximises its impact and makes a difference for the people it was established to benefit.”

Individuals

A Good Reason to Give…

As we mentioned, not every charity is eligible for the same concessions, and depending on whether a charity receives a certain concession, an individual’s donation may or may not classify as a tax deductible.

You are eligible for a tax deduction on your charitable donation IF your charity is registered as a DGR by the ATO. In this case, any tax paid on charitable donations you make towards this company can be refunded during your tax return.

So, how do you know whether your charity is a DGR?

Thankfully, most of the time, they’ll tell you. After all, it’s a good incentive to donate! If you’re unsure, however, you can find this information by searching your charities ABN number.

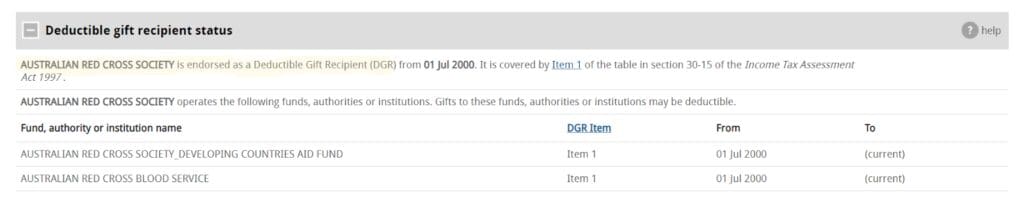

For example, if I search Red Cross Australia’s ABN and scroll down to check their DGR status, I can see that they have been endorsed by the ATO for this concession.

When a Donation is Not Tax Deductible

As mentioned, not all charitable donations are tax deductible – should that be a major factor towards your decision to donate. Sure, for smaller donations, it’s not a really big deal. On the other hand, if you’re donating large sums of money, it might leave a sour taste in your mouth knowing you’re paying tax on this figure.

In general, donations are not tax deductible if you’re…

- Giving to a personal fundraiser rather than a charity

- Giving to a crowdfunding platform (unless directly linked to a charity that is a DGR)

- Giving to a church (unless registered as a DGR)

- You receive something in exchange for your charitable donation (raffle, prize, dinner, etc.)

Starting a Fundraiser? Know the Laws!

Throughout the bushfire crisis, many individuals and groups stepped forward to raise funds on behalf of fire services, charities, and those affected by the bushfires. While this was a kind and thoughtful gesture, tax-wise it was a confusing area to navigate, especially where social media fundraisers crossed over with an individual’s employment.

Essentially, these groups were given large sums of money as individuals, meaning those who donated were not eligible to claim their donation as a tax deduction. Further, for those raised the money in their line of work (for example, Twitch users who fundraised over the platform), they had to claim it as assessable income before claiming it as a tax deductible expense – and this complicates things with their overall income and taxable income.

In general, there are a lot of grey areas when it comes to this modern world and crowdfunding or fundraising platforms. Right now, it’s all quite new and confusing. For individuals who take time to look at the legislation, it’s more complicated than you think being a fundraiser!

Starting a Fundraiser as an Individual

In short, it’s a lot of work starting a fundraiser as an individual. Essentially, you have either set up an organisation (which takes a lot of paperwork), join an organisation, or be super, SUPER dedicated to raising lots of money without taking anything off the top.

Starting a Fundraising Organisation

In Australia, there are different fundraising laws for each state. Those that get it wrong or fundraise unlawfully may receive reputational damage or legal penalties. Generally, if you’re wishing to undertake a fundraising activity, and you’ve consulted the relevant fundraising laws and legislation beforehand, you will have to request approval from the relevant jurisdiction (typically, your state government).

Much like in business, it’s important to monitor your accounting when running a fundraiser as you will have reporting obligations, and you may be subject to an audit. Thankfully, there are plenty of resources on the internet to help you navigate legislation when starting a fundraiser.

Depending on the state in which you reside, to fundraise you may have to:

- Register as a charity with ACNA

- Apply for a licence or sanction with Fair Trading

- Register with Consumer Affairs

Businesses

Businesses can give back in many ways. Businesses often provide donations (which may or may not be tax deductible, depending on the charity organisation); however, some businesses get more involved by donating employee time to volunteering. Data shows that when it comes to giving, Australian businesses, particularly larger corporations like Rio Tinto and BHP, give big. Koda Capital’s A Snapshot of Giving Australia report shows that Australian businesses gave $6.2 billion in donations, $7.7 billion in community partnerships and a further $3.6 billion in non-commercial sponsorships during 2018. Already, we’ve most likely increased those figures due to the bushfire emergency.

If you’re a small–medium business looking to donate or set up a philanthropic structure, it’s important to understand your financial situation. Giving is an incredibly rewarding aspect of business, especially if you have the means, but it’s also important to make sure your books balance out at the end. Always seek advice from a bookkeeper or accountant before developing any new and complex financial structures.

Shoebox Books provides bookkeeping and tax services to small to medium business, helping them stay on top of their incoming and outgoing expenses. We crunch the numbers so that they can focus on their goals. If you’re in urgent need of a skilled bookkeeper, contact Shoebox today.