How to Save Money & Reduce Your Bill This Tax Season

How we do work has drastically changed over the past year and a half. Many of us have swapped stuffy, overcrowded office spaces for the comfort of our own homes during 2022 and continue to make use of flexible “work-from-home” arrangements. One thing that none of us can escape – new normal or not, is paying our tax. But rest assured, effective planning and updating your finances over the year can make things a lot easier when it’s time to lodge your tax. It’ll quite possibly also save you a lot of cash. Here’s how!

As conscientious Australian citizens, we pay our tax to support the Government in providing public goods and services for the community. Being a compliant taxpayer means accurately recording and reporting everything on time and according to regulations. It’s not just the right thing to do; it’ll also make things a lot easier for you in the long run. However, there is no reason you should be paying more tax than you are required to – don’t get caught with a hefty tax bill by being complacent or unprepared during tax time.

But let’s suppose you’re one of the many Australians who’ve been ignoring the looming end of the financial year. In that case, it’s about time to closely examine your personal finances, including your income, investment, superannuation, home loans, and any assets you own, to ensure tax-effective outcomes and a much smaller tax bill!

Tips on Optimising Your Finances During Tax Time

- Keep accurate tax and financial records.

To prevent missing out on deductible items, keep well-organised records of your finances.

Download all statements you receive throughout the year, update your logbooks and put all receipts in a folder. There are many ways you can do this manually or digitally and securely.

- Make sure to claim all deductible expenses.

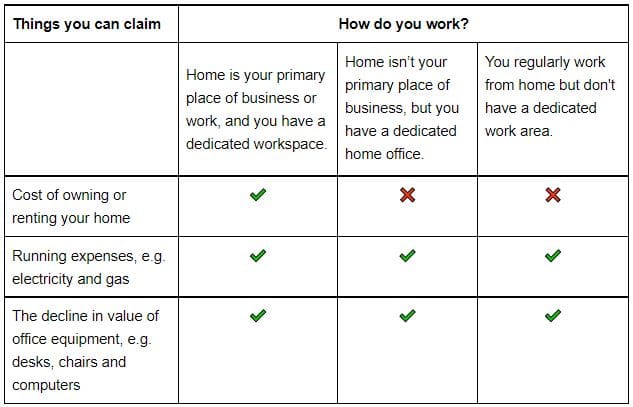

Don’t know what you can claim? In general, you can claim any expenses related to earning a taxable income, but you must have a record proving you made the purchase. That’s where those financial records come in handy. Any money you’ve donated to a charity is also tax-deductible. If you work from home, you can claim items including electricity expenses, cleaning costs, phone and internet expenses, stationery, and depreciation of home office equipment.

How to calculate your work from home expenses:

- Australian Tax Office rate per hour

If you’ve found yourself working from home over the last year, there will be expenses that you can claim during tax time. The ATO knows that it can be tricky to track all those expenses, particularly if you’re new to this type of working arrangement. To make things easier, they introduced a shortcut method for your 2020/21 tax return. You can use this method to calculate your home office expenses, even if you have minimal records.

To calculate your expenses, you now have three options:

- Shortcut method (80 cents per work hour) – available from 1 July 2020 to 30 June 2021, which you should had claimed in your 2020–21 tax return

- Fixed-rate method (52 cents per work hour)

- Actual cost method

Please note, using the 80 cents per hour short-cut method, you can’t claim other expenses concerning working from home (including your mobile phone and internet usage). In that case, the fixed-rate rate of 52 cents per hour may be more appropriate as it doesn’t include phone and home internet costs. When you make separate claims, you may find that the total is higher. A trusted tax agent can help you work out the best solution for your case.

- Review your income package.

Have you ever considered salary sacrificing? Salary sacrificing is a special arrangement you have with your employer to forgo a portion of your paycheck for employer benefits. For example, you could have the money paid into your Super account. The tax rate you then pay on this contribution is less than your marginal tax rate.

- Use a tax agent to keep tax time stress-free and save money.

Accepting help from a professional always means that you generate more profit and minimise your tax bill. A trusted tax agent can advise you on what to claim and not to claim, help lower your tax exposure and manage old tax debts. Is poor record-keeping affecting your finances?

A tax agent can get your books in order and up to auditing standards. But most importantly, they can spot anything you may have missed and work out the intricacies of your finances.

- Private health insurance versus Medicare Levy.

Don’t have private health insurance, and your income is more than $90 000? Then you will pay more than 1 per cent Medicare Levy Surcharge in addition to the compulsory 2 per cent already paid by taxpayers. Private health care can exempt you from paying this additional charge, as it often costs less than your gross income. This option may not be for everyone, so consider your health history and financial position and consult with a professional before changing your health insurance.

- Speak to your financial planner before deciding to invest.

There is no benefit to saving a small amount of tax now if a poor investment will lose you capital in the long run. This includes risky investments such as negative gearing. Working with a qualified financial planner or adviser can help make positive changes and get you one step closer to reaching your financial goals.

- Meet ATO deadlines at all cost – or risk a fine.

Missed a tax deadline? How embarrassing! Tax returns need to be lodged by October 31; if you missed the date and haven’t registered with a tax agent by 31 October (this may give you until 15 May of next year), you risk a late lodgement penalty of up to $1,110. So always keep an eye on due dates and ensure you meet key lodgement and payment deadlines.

- Plan ahead and create a well thought out tax strategy.

Nobody wants to be labelled a “tax avoider” or “tax cheater”. But it does happen – a lot. According to recent statistics, millions of Aussies cheat on their tax every year, even though efforts have been made to make the taxation procedure as straightforward, lawful and fair as possible for everyone. The ATO must ensure the efficient, effective, economical and ethical use of public resources. The taxation office does this by ensuring that you are paying the appropriate tax based on the documents you submit.

If thinking about your tax makes you nervous, focus on the objective: Financial growth and independence. A tax strategy will help get your documents in order, reduce the amount of tax you pay and give you peace of mind. Having a great plan, you’re a lot more likely to attain your financial goals.

Tax Time No-Go’s: What Should You Avoid?

While there are many tips to prevent you from paying excessive amounts in tax, there is a fine line between avoiding unnecessary tax and avoiding tax in general. Paying your tax is unavoidable; the aim is only to pay what you have to, not to avoid tax altogether.

Things not to do this tax season (or ever):

- Wait until the very last minute to do your tax.

- Mixing private expenses with business expenses.

- Claiming deductions that you didn’t pay for.

- Fill out a tax return with false information.

- Making risky financial decisions without seeking professional advice.

How Can a Qualified Tax Practitioner Help You?

A tax practitioner’s role lies in satisfying your needs as the taxpayer and the revenue authorities’ requirements. The Accounting Professional & Ethical Standards Board (APESB) issues standards that outline the responsibilities of accountants. It’s your job to choose the right tax agent and ensure they are registered by the Australian Governments’ Tax Practitioner Board.

Hiring a Tax Agent

The ATO provides you with simple tools and procedures to help you complete your tax return. That means you can save the tax agent fee; however, lodging your tax can still be overwhelming, time-consuming, and bears the risk of unintentional tax evasion. Hiring a tax agent can be extremely useful, whether or not you have complex assets or investments to deal with. As a bonus, they are also tax-deductible, which is beneficial for your overall tax outcome.

Tax time doesn’t have to be scary and daunting. If you are prepared and seek the affordable advice of a tax professional, you won’t end up paying more tax than you have to and might even gain financial benefits through the process. Shoebox’s accountants and bookkeepers offer fixed packages for small businesses and individuals intending to minimise your tax bill. Request a free consultation and find your tax agent today! Give us a call at 1300 565 35 83 or book an appointment online.