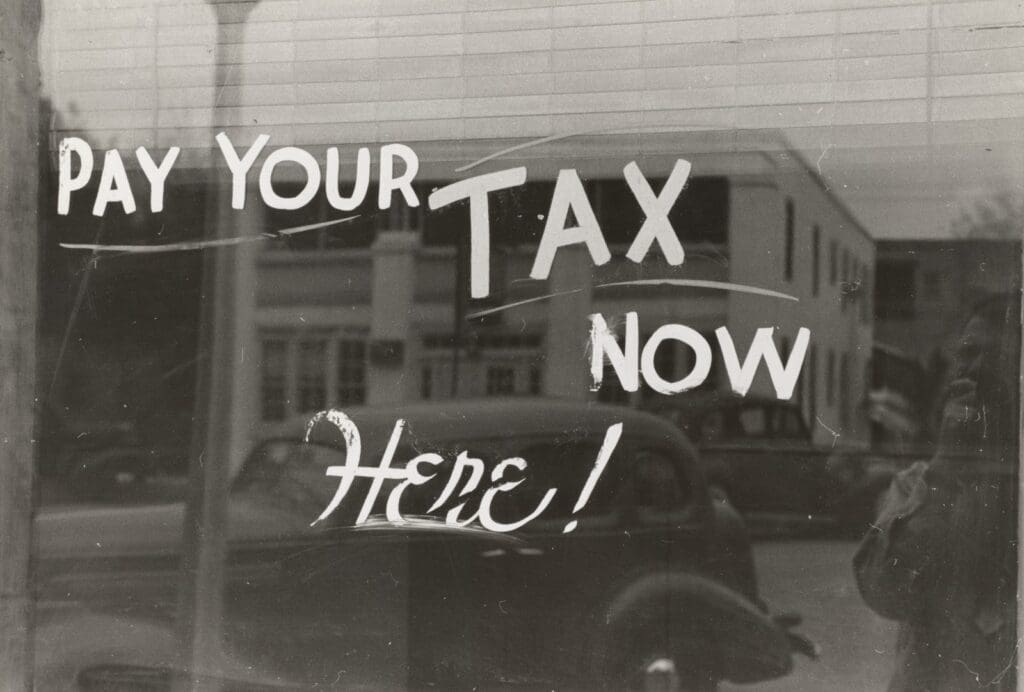

Are You Claiming ALL Possible Business Expenses?

The ATO has recently reported that nearly 90% of businesses pay their taxes voluntarily or with little intervention from the ATO. Deputy Commissioner Deborah Jenkins has explained that this means the majority of small businesses in the tax system do the right thing. “Small businesses make up more than 99% of all Australian businesses. They contribute $380 billion to the economy each year and employ around five million people,” Ms Jenkins reported to the ATO. Ms Jenkins goes on to say “Considering how much small businesses have on their plate, we’re grateful for the level of work they put in to get their tax right.”

While that’s much-appreciated recognition, tax time hurts many hard-working small business owners. Why be so honest when others are not? What are the 10% of non-compliant businesses doing?

It’s frustrating; but still glaringly true that small businesses bear the brunt of the tax time burden. Compared to large companies that seem to employ tax-cutting measures to evade certain taxes, small and medium-sized enterprises (SMEs) with tight resources are spending the majority of their time working, and planning out how to scale and grow, rather than concocting tax evasion strategies.

Come time to do your tax return, are you claiming all of your business expenses?

The Income Tax Gap

The tax gap is an approximation of the amount of tax NOT paid to the ATO due to non-compliance with taxation law. While driving factors contributing to the tax gap can include genuine errors and global forces…

“The minor gap in the small business income tax is attributed to black economy behaviour,” the ATO reports.

Black economy behaviour includes hiding income, exaggerating expenses, and operating outside of the Australian tax system. Black economy operations are said to cost the Australian community approximately $50 billion annually.

To combat this problem a Black Economy Taskforce was established in 2016. Since 1st July 2018, the ATO has deployed an extensive program to tackle the black economy.

“We’ve stepped up our enforcement activities, including highly visible mobile strike teams. We visited close to 10,000 businesses around the country last year and we plan to visit another 30,000 over the next three year.”

How would your books fare if this task force knocked on your door?

So, how do small businesses keep on top of tax?

The ATO finds that “around 90% of small businesses use a registered tax professional to help them comply with their income tax obligations.”

“We recognise the important role that tax professionals have in helping small businesses get their tax right and we would not have been able to achieve this result without the support of our tax professionals,” Ms Jenkins said.

Not only do qualified and reliable tax professionals assist businesses with keeping their finances in order, but advancing technology and bookkeeping software has enabled business owners, their bookkeepers and accountants to keep track of financial matters in a more efficient and accessible manner.

“In addition to seeking qualified advice from a registered tax professional, we know that small businesses who keep good records and have invested in record-keeping software are more likely to get their tax right.”

We agree. Our small business clients feel less unnecessary stress and pressure come tax time. With professional advice and efficient software, they have access to a clearer financial forecast at their fingertips, to better plan incomings and outgoings in line with business goals. Frankly, doing so means fewer surprises come 30th June.

By enlisting professional help with the books, small businesses are also likely to uncover more claim opportunities.

Are You Claiming ALL Business Expenses?

The vast majority of Australian small businesses are doing the right thing, which is great news. However, with black economy taskforce running around spot-auditing businesses, it’s important to understand exactly what taxes you’re required to pay, and what you’re entitled to claim in your tax return.

If you feel like you’re being drained by tax expenses and see little in return, perhaps it’s time to revisit your deductions. Every little expense adds up over the course of a financial year.

General operating expenses:

You are entitled to claim a percentage of the expenses you incur throughout daily activities in your business. Obvious examples include office stationery, the purchase of trading stock, and the cost of renting your office or business space. Some commonly overlooked expenses that can be deducted include:

- Marketing and promotional activities

- Costs for running your website, including maintenance, updates and service provider fees.

- Waste removal and recycling expenses

- Parking related fees (but unfortunately not parking fines)

- Tender costs – even those that didn’t have a successful outcome

- PR expenses

Ensure that you keep a record of these expenses by scanning or take photographic evidence of all receipts.

Motor vehicle expense:

If you have a car that you use for your business, you are entitled to receive deductions on the expense of using and maintaining that vehicle. If your business operates under a company or trust there are additional motor vehicle claims you can leverage:

- Registration

- Oil and fuel

- Interest on motor vehicle loans

- Depreciation

Travel expenses:

Are you or your employees required to travel for business? While most small business owners are aware they can claim airfares and accommodation, if your work requires you to travel, you can also claim basic living expenses while you’re away.

- Meals

- Laundering expenses

- Car hire or public transport fees

- Parking, road tolls and fuel

Repairs and maintenance:

This covers the maintenance of business machinery, tools, and the premises you occupy. Larger expenses such as painting, or appliance and machinery repair are typically claimed; but what about some of the smaller items you address?

- Plumbing maintenance and leak repair

- Replacing broken fencing or windows

- Gutter cleaning and conditioning

Home office:

Many small business operators conduct business tasks at home – whether they have a brick-and-mortar business or not. Are you claiming your home office operating expenses?

- Home office equipment

- Stationery

- Home office cleaning expenses

- Percentage of phone and internet

- Percentage of electricity

Pre-paid expenses:

You can receive deductions on prepaid purchases you made before the end of the financial year that go into the next financial year. Such expenses may include:

- Rental payments

- Insurance premiums

- Membership expenses to a trade or peak body

Bad debts

Have you included an unpaid debt in your accessible income in the current or any former year? Or have you lent money that has gone unpaid? You can claim bad debt as a deduction as long as it is written off as “uncollectible.”

To qualify as an uncollectible debt you must demonstrate:

- That the debt exists

- That the debt is bad

- That the bad debt is written off during the year in which the deduction is claimed

- That the debt was brought to account as assessable income

You’ll also need to prove that you have made a genuine attempt to recover any bad debts.

What Else Can Your Business Claim?

Instant asset write-off:

The instant asset write-off is an excellent incentive offered by the government to encourage businesses to upgrade equipment and assets in order to grow their business. From 2nd April 2019 businesses with a turnover between $10 and $50 million are eligible to claim a deduction for each asset purchased under the $30,000 threshold.

This is a great way to lower your taxable profits and acquire capital assets required to scale and grow your business.

What Happens If You Overclaim on Tax?

While it’s in your best interest to deduct the maximum possible amount you’re entitled to, it’s also important to be truthful, otherwise, you could face harsh penalties. The ATO states that:

Deliberate attempts to overclaim can attract penalties of up to 75% of the claim.

In particular, the ATO is cracking down on work-related expenses and rental claims—these obviously apply to individuals as well as businesses.

What Records Should You Keep?

Remember to always, always keep your receipts. Tax law requires you to keep your tax receipts for 5 years. The records you should keep include:

- sales receipts

- expense invoices

- credit card statements

- bank statements

- employee records (wages, super, tax declarations, contracts)

- vehicle records

- lists of debtors and creditors

- asset purchases.

It’s a good idea to keep an electronic copy as paper receipts and invoices tend to fade over time.

Getting Help With Your Business Finances

The best method to ensure you efficiently balance your business finances and keep the taxman happy is to plan ahead. Being prepared for EOFY with enough healthy cash flow and tax owing put aside will keep you and your business in good stead for the next financial year, allowing you to focus on growing your business. If you need help with the books and maximising your claim entitlements in order to keep what is rightfully yours, get in touch with your friendly local Shoebox bookkeepers – your bookkeeping expenses are tax-deductible after all!

Our philosophy is to empower business to realise their business dreams.