Hacks To Improve your Cash Flow

Business owners know all too well the struggles of keeping up with the business’ finances. Do you find it a headache to keep on top of it all? While it’s tempting to leave the books to the accountant come tax time, cash flow problems can seemingly arise out of nowhere, disrupting your business, your plans and your ability to scale.

Poor cash flow is one of the main reasons over 60% of small businesses in Australia fail within three years – despite their potential.

There is a lot of chatter at the moment about the future of our economy, it’s more important than ever to be prepared and stay positive…particularly cash positive. Here are our top hacks to help you keep on top of your books, and avoid a costly cash flow crisis. It’s worth the investment to sharpen your bookkeeping game so you can stress less, and enjoy focusing on growing your business.

Cash Flow Analysis

Take a step back to examine where, and when your finances are coming and going. In the ebb and flow of business, you will identify patterns and trends, giving you the ability to plan for your expenses, and any seasonal downtimes.

Analyse your spending and see where you should be a little more thrifty, and where you can cut back on your expenditure. Ideally, you should do this at least once per month; especially for a new business to ensure you’re on a budget, can meet your payroll and supplier obligations, and are heading in a healthy direction. If the analysis shows you might bump into trouble in the future, you have the time to plan. You might find you need to cut costs, accelerate your income or arrange short-term financing to avoid falling too far behind.

Develop a Budget

Preparing an annual, monthly, or even weekly budget can help you track whether or not you need to increase revenue, or cut costs. List your expenses first, and calculate your target income in order to maintain healthy cash flow, make savings or investments, and keep your bottom line in the black.

Your budget can help you determine whether or not your goals are realistic if you need to increase profit margin or reduce stock levels or expenditure in order to support continued growth.

Pay As You Go Equipment

Is it necessary to pay for stock or equipment outright or upfront? Your aim in business is to save money, create a healthy surplus and grow. Why tie up much-needed cash in the bank if you can lease equipment, or negotiate better payment terms with your suppliers. Remember you are their customers, and they want your business just as much as you want your customer’s business.

Offer Vouchers and Gift Cards

This is a great way to get paid upfront for your products or services. Instead of having to absorb the cost of goods or services as they await a customer’s purchase or invoice payment, you have cash in the bank pre-sale.

Vouchers and gift cards are easy and effective to promote and distribute at low cost.

Hire a Bookkeeper

It doesn’t hurt to ask for assistance when you need it. If crunching numbers and analysing your cash flow situation is not your strength, why put yourself through the pain? Hire a reputable bookkeeper to help you regularly input and consolidate your incomings and outgoings, generate reports and form recommendations for your consideration.

Your bookkeeper will also meticulously prepare your business finances for dreaded tax time. A great bookkeeper means minimal surprises when it comes to your actual cash flow situation, and maximum support so you can concentrate on your forté – your business!

Chase Up Unpaid Invoices! – In The Least Awkward Way Possible

It’s very common for service-based businesses to run into cash flow problems due to late payment of their invoices. According to Xero, more than 40% of invoices are paid late!

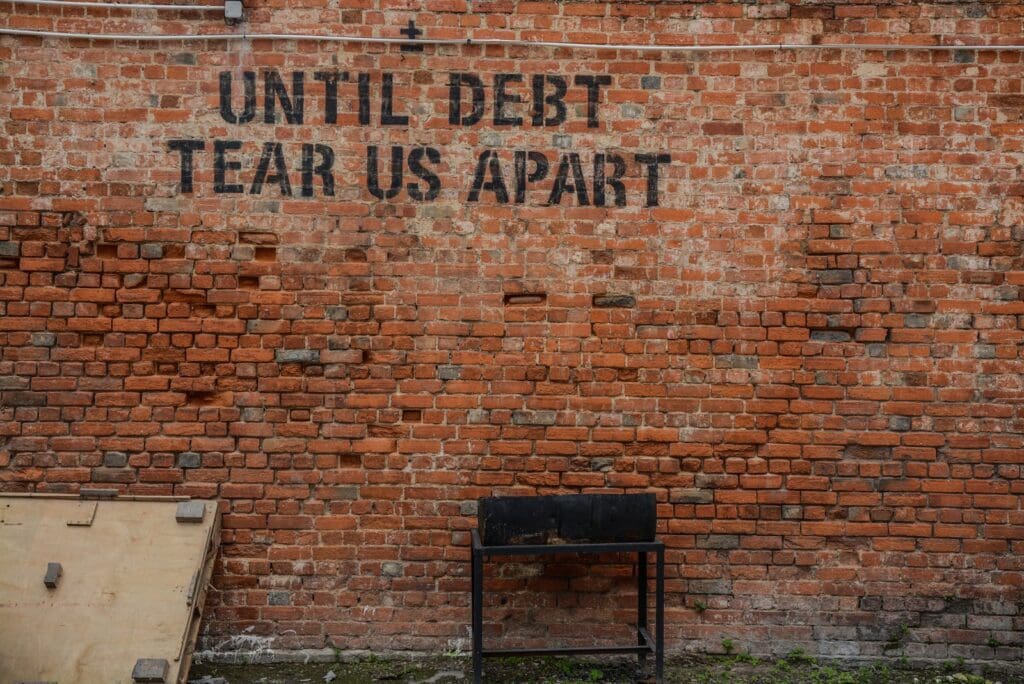

Nobody enjoys having to chase debt. You’ve worked hard to build relationships with your customers, the last thing you want to do is hassle them for payment. The more you let those overdue invoices slide…the more you will fall behind yourself; and the more your customers might take advantage of your kindness. Are your invoices getting to 5, 10 or 30 days past terms? That is valuable hard-earned cash you need to keep your business moving forward.

To make receivables management more efficient and less cringe-worthy, here are our tips.

Professional Accounting Software

Top business accounting software systems like Xero have an invoice reminder system that will automatically forward your customer’s an email when their invoice is coming up for payment, and/or when it fall’s past due. You can customise your message to be a little softer than the average late payment notice if you’d like to take a gentle approach.

Shorten your payment terms

The 30-day payment term is fast becoming old news from the days of posting invoices and cheques. With electronic payment at our fingertips, there’s no reason why you shouldn’t be paid on the invoice, or within 7 days for your completed work.

Allow more payment options

Some people like to pay bills with their credit card, others like EFT or BPAY, some conduct all their business with their cheque book. And many people still prefer good old cash. The more payment options you accept, the more likely you are to get paid faster. Just don’t forget to deposit those cheques in good time!

Ideally, if your business operates on a repeat subscription or retainer basis, you can set your customers up with a direct debit system. Maximise your chances of collecting your receivables automatically, and on time.

Consider adding ‘overdue’ fees

If your invoicing system is streamlined and professional with clearly outlined payment terms, you’re entitled to charge interest if your terms are ignored. While this practice does often get your invoice paid – be prepared for some stern words from your customers.

If relationship management is important in your business, perhaps consider an alternative option, like a discount for invoices paid early…rather than a fee for late payment.

Review your terms of service

Sound terms of business are often overlooked. These are the terms and conditions laid out for your customer to sign off on and agree to before your services are engaged.

Your terms can include rules and expectations such as

- The refund process (if any) if the customer is not happy with your product or service

- Payment expectations (payment upfront, percentage deposits or periodic payments)

- Late fees and collection costs on late payments

- The procedure if the work is delayed or cannot be completed due to events outside of your control – poor weather for example.

Making your customer aware of the conditions of hire upfront means no surprises come invoicing time. It will also put you in good stead should you be required to embark on a legal debt recovery process.

Talk to your local industry association, a lawyer or your colleagues and peers to get solid terms most suitable for your industry.

Get help from your bookkeeper

When all else fails, you need to get on the phone to find out why you’re not getting paid. Your customer might have fallen on hard times, perhaps a payment plan might work for them. Maybe you have the contact details wrong, or it could be that they weren’t happy with your work! These are all the things you need to know so you can rectify any issues, and ensure you get paid. If you’re not comfortable with making these calls and would rather maintain your friendly relationship with your customer, ask your bookkeeper for help.

Pay Your Dues on Time

When you’re a little lean on cash it’s easy to slip behind in your owings. “Oh, I’ll just pay this bill a little late while I wait for my invoices to be paid.” This is a dangerous cycle that once you’re in, it’s difficult to get out. Instead of falling behind in your payments, uncover other ways to cut costs. Discuss your situation with suppliers and try to negotiate alternative terms to keep you cash positive and on top of your bills.

Sell Invoices

Did you know there’s such a thing as invoice finance and spot factoring? If your receivables are always late and keeping you in a negative cash flow chokehold, you could consider selling them for cash. When you sell an outstanding invoice to a third party, they take on the risk associated with the credit you’ve issued. For a small fee, you get access to the money you need straight away to cover your expenses. It’s a different way of doing things, but this cash flow hack can help keep your books in the black and not in the red.

Embrace Bookkeeping

Good bookkeeping is like business finance intelligence. Generally the old saying, ‘you have to spend money to make money’ is true. But it’s critical to have a sound budget and cash flow analysis systems in place to ensure your outgoings don’t exceed your incomings.

Regardless of your industry or how you budget, the aim for every business is to stay afloat and expand to greater heights. To keep business booming the way it should, your cash needs to maintain its flow in a healthy stream.

With airtight cash flow management, you will always have a clear picture of your current and future situation, and fair warning to be proactive and act on potential financial issues. We’re in business to follow our dreams and make a profit, all the hard work in the world can’t pay off with neglected cash flow. Make your work life easier with rock-solid books. Happy accounting!