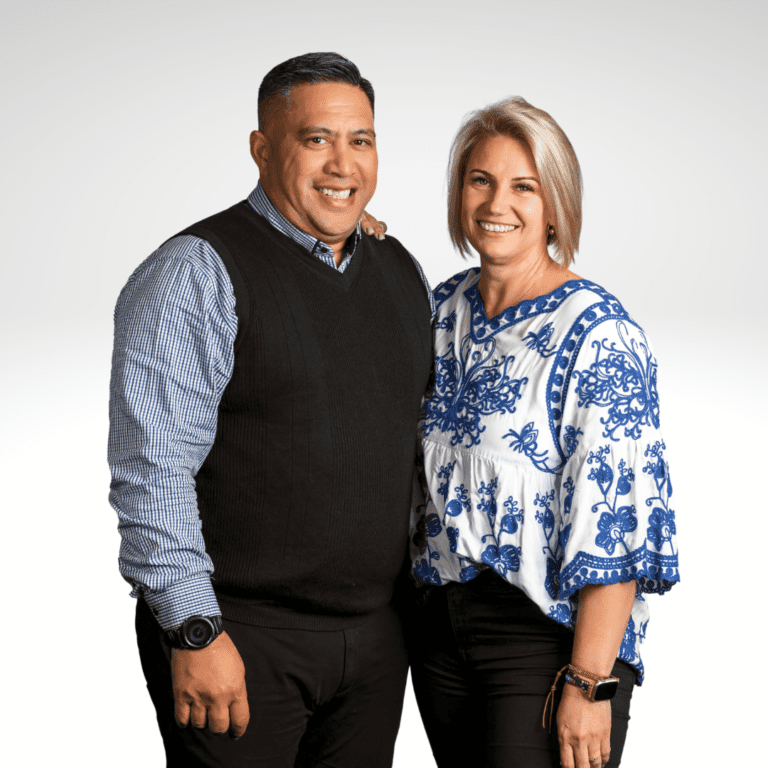

Jason and Amy from Shoebox Books and Tax have been absolutely incredible! I had a significant backlog of both business and personal finances, and they handled everything seamlessly. Their expertise and efficiency made what felt like an overwhelming task so much easier.

Not only was their process straightforward and stress-free, but their communication was also fantastic every step of the way. They kept me informed, answered all my questions, and ensured everything was sorted with professionalism and care.

I highly recommend Shoebox Books and Tax to anyone needing reliable, knowledgeable, and friendly bookkeeping and tax services. Thank you, Jason and Amy, for making this process so smooth!